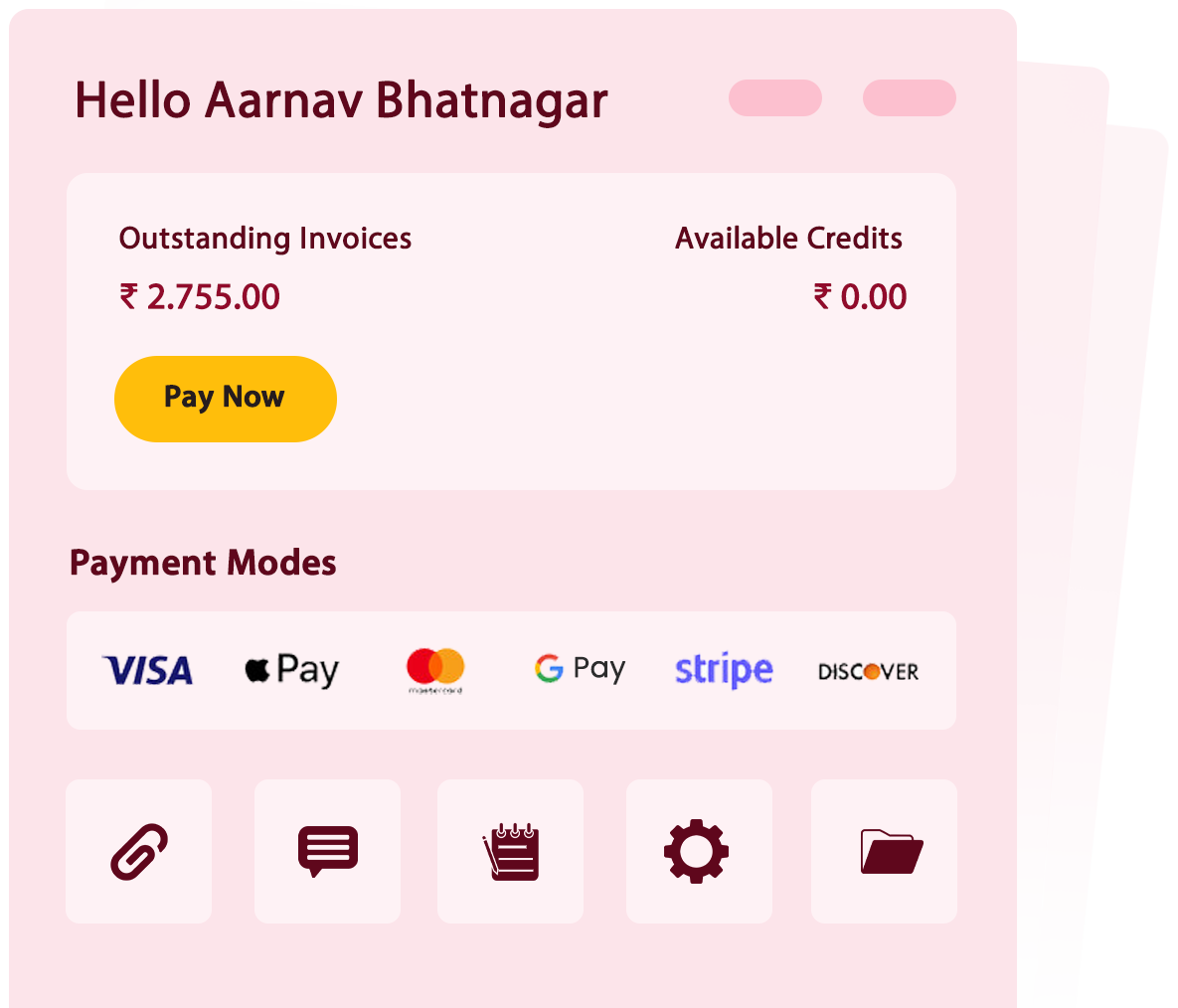

Optimize payment processes by presenting customers with secure multiple payment options for prompt transactions.

Features

Features

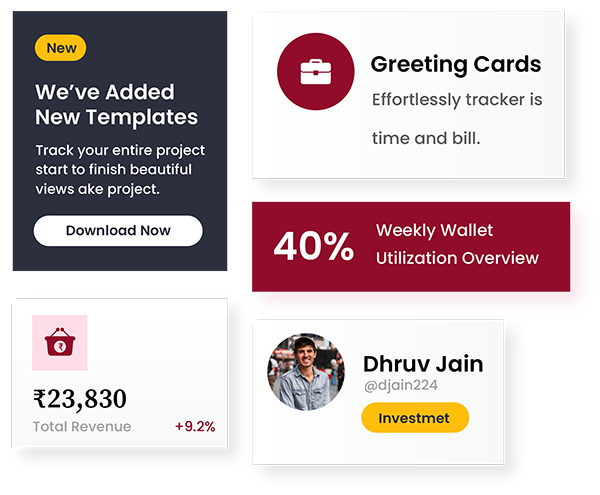

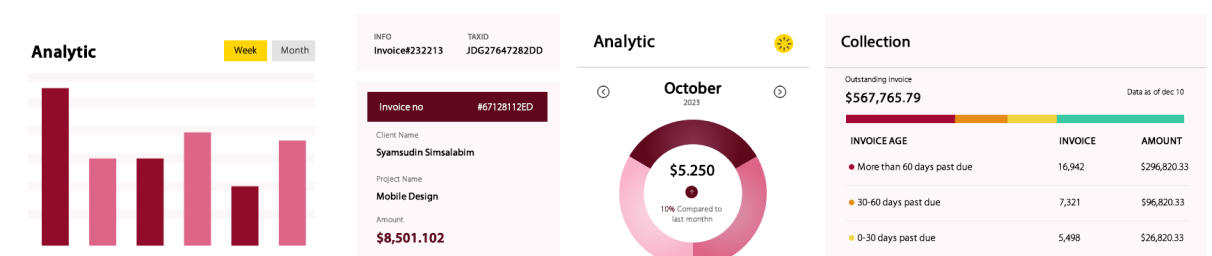

Track your entire project from start to finish with beautiful views that make project planning a breeze manage your resources.

Easily create professional invoices with our user-friendly invoice generator.

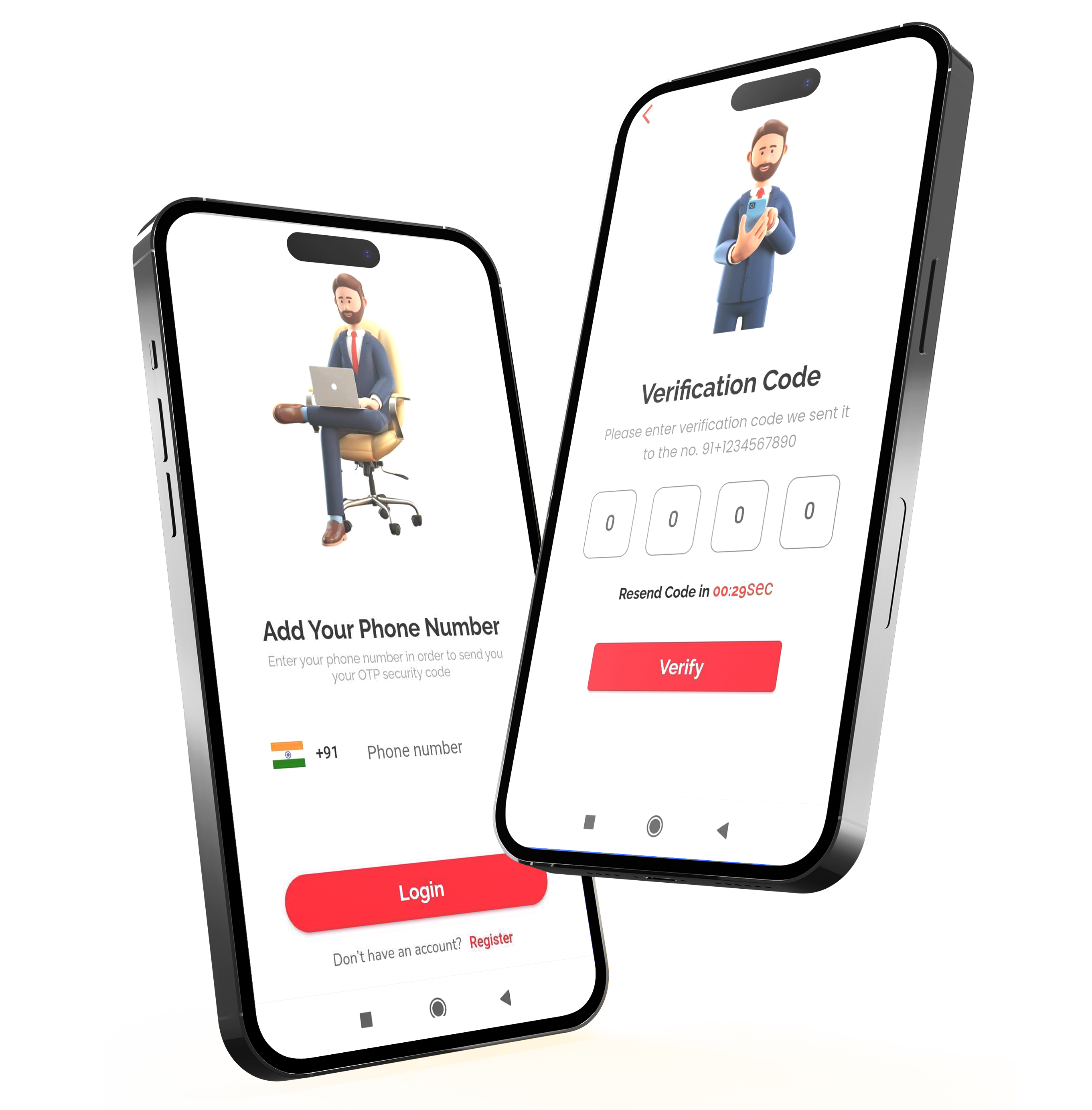

We live with cloud, so you can easily access us with the best invoice software.

Manage invoicing, subscriptions, payments, & more. Track time & generate reports.

One bif family of 3 million users from 40+ countries. complete customization of online.

About Rokdi

About Rokdi

Why Choose Us

Why Choose Us

Track your entire project from start to finish with beautiful views that make project planning a breeze manage your resources.

Our system streamlines invoicing, giving you more time to focus on business development.

Boost efficiency with our integrated tools, driving streamlined business operations and success.

.png)

Process

Process

Streamlines billing, converts data into invoices or estimates.

.png)

Take advantage of a fully-featured array of configurable business reports and summaries so you always know where your company stands.

.png)

Accept credit cards and a variety of payment methods from the start, and allow clients to pay directly from your invoice.

.png)

Track hourly billable tasks, expenses, and trips easily and quickly convert them into stylish invoices or estimates.

Benefits

Benefits

Streamline your billing process and improve accuracy with automated invoicing.

Billing software helps to provide trade specialized solution which automates your business workflows as per your need with personalized & advance template invoices, with our multiple software configurations.

Our billing tool enables seamless collaboration with your customers, allowing you to send orders, invoices, and emails using your customized templates at no additional cost.

Additionally, our billing tool provides a secure and user-friendly interface, ensuring a hassle-free experience for both you and your customers.Our dedicated support team is available to assist you with any billing inquiries or technical issues.

It improves the performance of your business by taking the maximum benefit and advantage to stay on top. With our billing software, you can boost your business and get rewarded in endless ways.

Testimonial

Testimonial

Our Clients send us brunch of smiles with our services and we love them.

"Unbelievable convenience! This software has transformed our invoicing process. Creating, sending, and tracking invoices has never been this seamless."

"Game-changer! I used to spend hours managing invoices manually. Now, with this software, I have more time to focus on growing my business."

"Efficient and user-friendly! The ability to send secure invoices instantly has improved our client relationships and cash flow management."

"Absolutely invaluable! This software has simplified invoicing beyond belief. Now, our invoicing process is smoother and more organized than ever."

FAQs

FAQs

Rokdi is a comprehensive financial management software that can help you with anything from budgeting and cost monitoring to invoicing and reporting.

Rokdi is a comprehensive financial management software that can help you with anything from budgeting and cost monitoring to invoicing and reporting.

Absolutely! Rokdi is intended for both corporations and people. It provides personal finance management tools that make it simple to track expenses, plan budgets, and achieve financial objectives.

Rokdi provides a range of features, including expense tracking, budget creation, invoicing, payment reminders, financial reporting, and integration with popular accounting platforms.

Your data security is our priority. Rokdi employs advanced encryption protocols to safeguard your financial information, ensuring it remains confidential and protected.

Yes, our customer support team is here to assist you. Reach out to us through email or our dedicated support platform, and we'll be happy to address your questions and concerns.

Efficiently manage transactions by sending invoices

promptly

through our platform.

Copyright 2024 Rokdi | Made with ❤ in India